Beginner’s Guide to On‑Chain Data: Wallet Flows & Whale Signals

Get Breaking News First!

Editor’s choice

Want to front-run the market? Follow the money.

And in crypto, that means on-chain data.

Every transaction, whale shuffle, and exchange inflow is public… if you know where to look. This guide breaks down how to read those signals using free tools like Etherscan, Glassnode, and Dune. Because if you’re not watching wallet flows, you’re flying blind.

Join our community of 400K+ and never miss breaking news!

We respect and protect your privacy. By subscribing your info will be subject to our privacy policy . Unsubscribe easily at any time

Let’s decode the blockchain.

Why On-Chain Signals Matter Now

2025 is a data-driven battleground. Bots scan mempools, hedge funds scrape block explorers, and alpha lives in speed and interpretation. Knowing when whales accumulate or move off exchanges is like having night vision in a foggy warzone.

Retail typically reacts to price. Smart traders react to the flow.

On-chain data shows sentiment shifts before the charts do.

Just focus on:

🔹 Volume-adjusted wallet flows

🔹 Whale behavior trends

🔹 Timing around key price levels

Free Tools to Read Wallet Flows

Etherscan & Whale Alert

Screenshot from Etherscan homepage

Want to see when a whale moves $50M in ETH to Coinbase? Start here.

Etherscan lets you tag addresses (Binance, Alameda, GSR, etc.), track their transfers, and set alerts. If the move is toward an exchange, it’s often a prelude to distribution.

Pair with Whale Alert for real-time significant transfer tweets. But be smart: not every 7-figure TX is alpha. It could be an internal shuffle. Finally, link it to smart money wallet activity for added context.

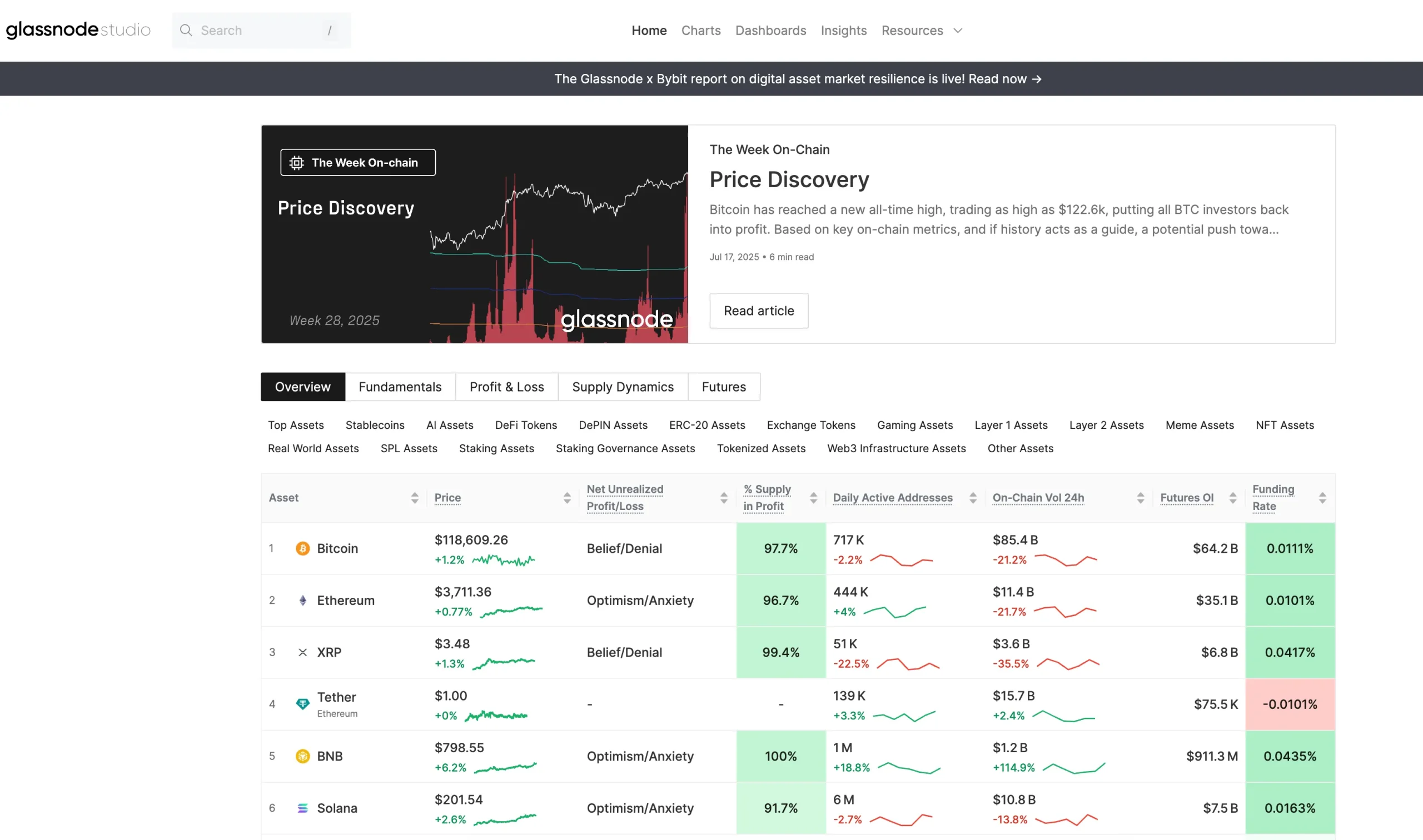

Glassnode Dashboards (Free Tier)

Screenshot from Glassnode Studio

Use Glassnode to spot early market moves—like when whales start selling or holding.

✅ Netflow: See if more crypto is moving into (bearish) or out of (bullish) exchanges.

✅ Whale Cohorts: Track big wallets (1K+ BTC) to spot accumulation or dumps.

✅ Dormancy & SOPR: Show if long-term holders are selling into rallies or staying strong.

Bonus: Clone dashboards made by top analysts to follow stablecoin flows, token launches, or fresh DEX activity, without building from scratch.

Join our community of 400K+ and never miss breaking news!

We respect and protect your privacy. By subscribing your info will be subject to our privacy policy . Unsubscribe easily at any time

If you’re tracking altcoins, this is where edge lives.

Trade Triggers That Matter

Traders have a few strategic choices.

Combine on-chain data with technical indicators and price action to filter false alarms. Don’t trade based on a single whale transaction—context, confluence, and confirmation are key.

Smart Setup Routine

- 🔔 Set Etherscan Alerts: Tag top wallets like Alameda, Jump, Celsius, and get instant alerts on any big moves. Use wallet profiler tools to discover related wallets.

- 📲 Follow Whale Alert & Glassnode: Turn on Twitter/X notifications. These accounts often flag large transfers before the price reacts. Pair this with manual analysis on Glassnode Studio.

- 📊 Clone Dune Dashboards: Save dashboards tracking exchange balances, whale clusters, and stablecoin flows. Save them to your account and configure push alerts through integrations like Zapier or Discord bots.

- 📉 Check Liquidity Zones: Pair on-chain moves with order book data using TradingLite or TensorCharts. That’s how you spot real signals, not bait.

Not every big move is a market mover. Context is king. But when the clues line up, on-chain data becomes your edge.

Trade with Insights; Don’t Bet Blind

Reading on-chain data isn’t just for whales. It’s for anyone serious about staying ahead of retail lag.

Learn where size is going, and the market makes more sense. It’s that simple.

Join 20K+ traders in our Telegram community for live signals, data drops, and alpha from the frontlines. Also, subscribe to our weekly newsletter to stay updated on everything trending in crypto and TradFi.