🏆 The 10 Golden Rules of Crypto Trading (Beginner Edition)

Get Breaking News First!

Editor’s choice

Crypto trading isn’t just about catching pumps. It’s about not blowing up while you learn the game. These aren’t magic signals or secret whale strategies. They’re the boring, unsexy rules that quietly separate traders who survive from traders who rage-quit after one bad cycle.

If you’re new to the space, memorize these. If you’re not, review them until they’re instinct.

🥇Rule 1: Protect Your Capital Like It Owes You Money

You can’t trade if you’re broke. Your capital is the business. Treat it like that.

Join our community of 400K+ and never miss breaking news!

We respect and protect your privacy. By subscribing your info will be subject to our privacy policy . Unsubscribe easily at any time

Preserving capital gives you staying power. That’s what separates traders who last from those who rage-quit.

🥈Rule 2: Set a Stop. Every. Single. Time.

No stop = no strategy. Price doesn’t care about your feelings.

A stop-loss isn’t a weakness. It’s insurance. You wouldn’t drive without brakes—don’t trade without stops.

🥉Rule 3: Never Revenge Trade

A bad trade hurts. A revenge trade kills.

A loss isn’t failure. But reacting emotionally to one? That’s how blow-ups happen. Start here.

🧱Rule 4: Risk Only What You Can Emotionally Afford to Lose

If a single trade is keeping you up at night, you’re not “ambitious” — you’re overexposed.

The market doesn’t care about your emotional comfort. Your risk plan is the only thing that should.

If you’re not sure how to size correctly, fix that here>>

🧠 Rule 5: Trade With a Thesis, Not a Hunch

Have a reason for every trade. If you can’t explain it in one sentence, skip it.

Clarity before entry leads to discipline during volatility. Vagueness leads to panic exits.

💔Rule 6: Don’t Marry a Bag

You’re a trader, it’s not a cult. If the trade fails, divorce it.

Bagholders rarely recover. And even if they do, they wasted time that could’ve been redeployed elsewhere.

Join our community of 400K+ and never miss breaking news!

We respect and protect your privacy. By subscribing your info will be subject to our privacy policy . Unsubscribe easily at any time

🧰 Rule 7: Keep It Simple, Especially Early

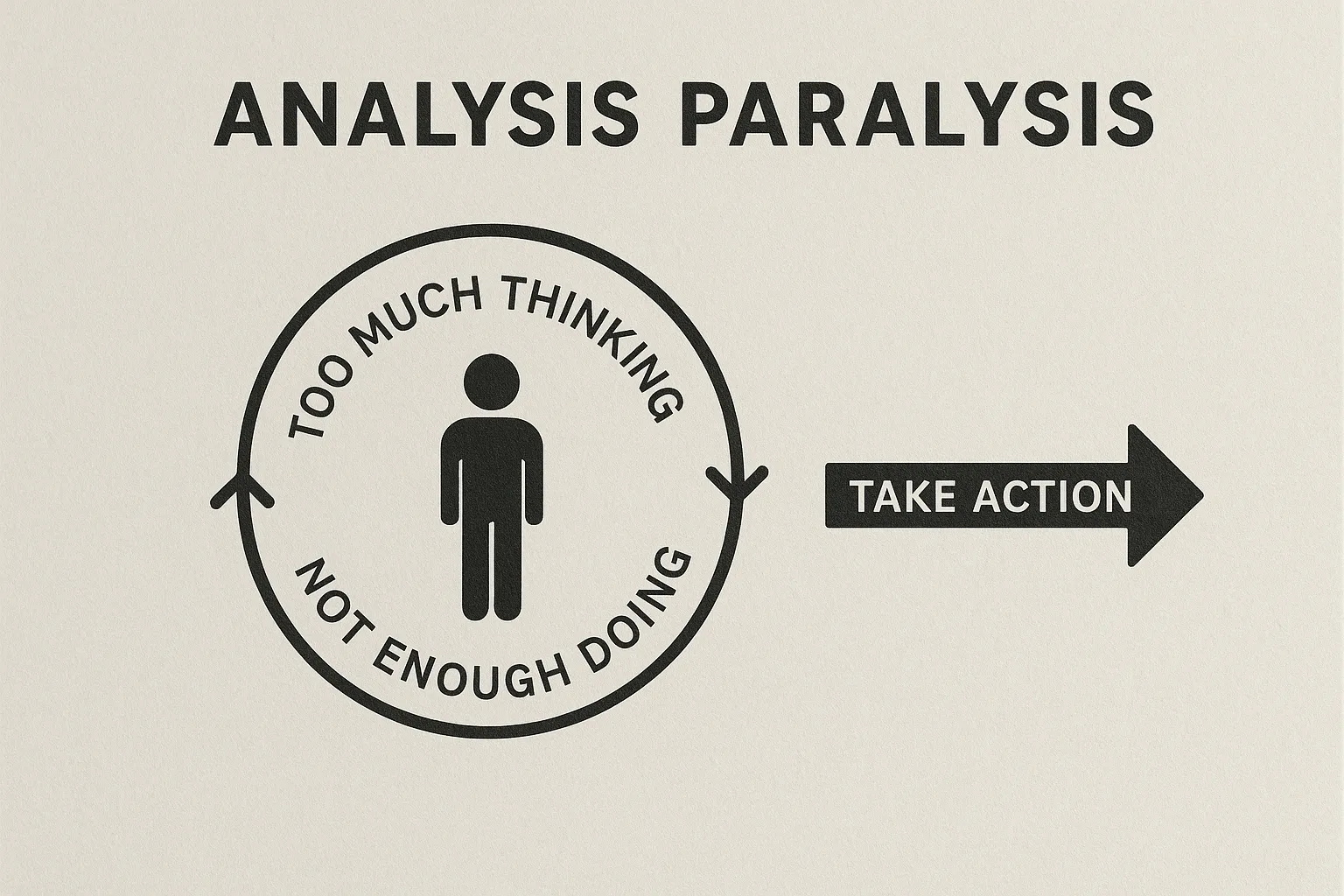

You don’t need 12 indicators, 5 timeframes, and a moon phase tracker to take a trade. Overkill kills clarity.

The more complexity you add, the more excuses you give yourself when a trade fails. Keep it clean.

📓Rule 8: Journal Every Trade

Discipline without data is blind. If you’re not tracking, you’re not improving.

Your journal is your trading mirror. Without it, you’ll keep making the same mistakes… just on different coins and bigger size.

🔍 Download our FREE journal to track everyday trade.

🎯Rule 9: Don’t Chase Every New Shiny Thing

If you’re constantly switching coins, you’re not trading — you’re drifting.

Yes, airdrops are cool — but so is having a strategy.

💼 Rule 10: Build Your Portfolio With Purpose

Trading is one tool, not the whole toolbox. If you don’t know what your money is supposed to do, you’ll keep misusing it.

Start with this 5-step plan. If you don’t know what your capital is meant to do, you’ll keep misusing it.

✅ Final Takeaway

The rules are simple. Following them is not.

Every blown account starts with ignoring one of these. Don’t be the lesson. Be the exception.

Smart trading isn’t sexy — it’s systematic. Stick to the rules and let everyone else chase unicorns.

Subscribe to our newsletter and join our Telegram of 20K+ traders for real-time insights, tools, and no-BS strategy drops.

Trade smart. Stay sharp.