The 5 Biggest Crypto Investing Mistakes and How to Avoid Them

Get Breaking News First!

Editor’s choice

You’ve heard the legend; someone turned $500 into $50K on a meme coin. What you don’t hear about are the thousands who blew up their portfolios chasing the same move. In crypto, most losses come from the same repeated mistakes. Let’s break them down, and how to avoid them.

That added privacy is exactly what makes these cryptocurrencies powerful, controversial, and increasingly scrutinized. Understanding how privacy coins work is essential before using them or investing in them.

🚨 Mistake 1: FOMO Buying Without Research

When the market starts flashing green like Times Square on New Year’s Eve, greed kicks in fast. Your brain starts telling you this one’s different. That’s usually when things go wrong.

Join our community of 400K+ and never miss breaking news!

We respect and protect your privacy. By subscribing your info will be subject to our privacy policy . Unsubscribe easily at any time

But greed will wreck you faster than a typo on a blockchain transaction.

Before you ape into the next hyped token, slow down. Read the whitepaper and figure out what the project actually does, not what Twitter says it does. Check who’s building it, who’s backing it, and whether the token has real utility beyond price action. Watch the community too. If it’s all influencers, countdowns, and “don’t miss this,” you’re probably looking at exit liquidity.

If it sounds too good to be true, it almost always is.

🧺 Mistake 2: Putting All Eggs in One Crypto Basket

Going all-in on a single coin is one of the fastest ways to blow up a crypto portfolio. When altcoins crash, they don’t politely dip, they disappear in a puff of smoke.

The smartest thing to do is learn how to build a crypto portfolio like a pro. One strategy you could use is splitting investments across Bitcoin, Ethereum, and three to five solid altcoins, limiting each position to 5-10% of your portfolio.

📩 Mistake 3: Investing Money You Can’t Afford to Lose

Gambling with rent money isn’t investing, it’s playing Russian roulette with your finances. Bitcoin has dropped over 75% multiple times in its history, and when that happens, emergency funds don’t “recover.” They vanish.

Crypto volatility means only one rule matters more than any strategy: only risk money you can afford to lose. Fun money. The kind you’d spend on a weekend trip or a concert and move on. Rent, mortgage payments, emergency savings, and borrowed cash are off-limits — no exceptions.

If your crypto allocation puts basic life expenses at risk, the problem isn’t the market. It’s the sizing.

🧯 Mistake 4: Emotional Trading

The crypto market doesn’t care about your feelings — but somehow they still decide your entries and exits. Hype pulls you in at the top, fear kicks you out at the bottom, and the cycle repeats until the account’s cooked — classic revenge trade psychology in action.

The fix is boring, and that’s the point. Set your entries and exits before FOMO shows up. Use dollar-cost averaging to stay consistent instead of reactive. And kill the constant price alerts — staring at every tick turns noise into bad decisions.

Crypto punishes emotion and rewards structure. Get your trading psychology under control, and half the battle is already won.

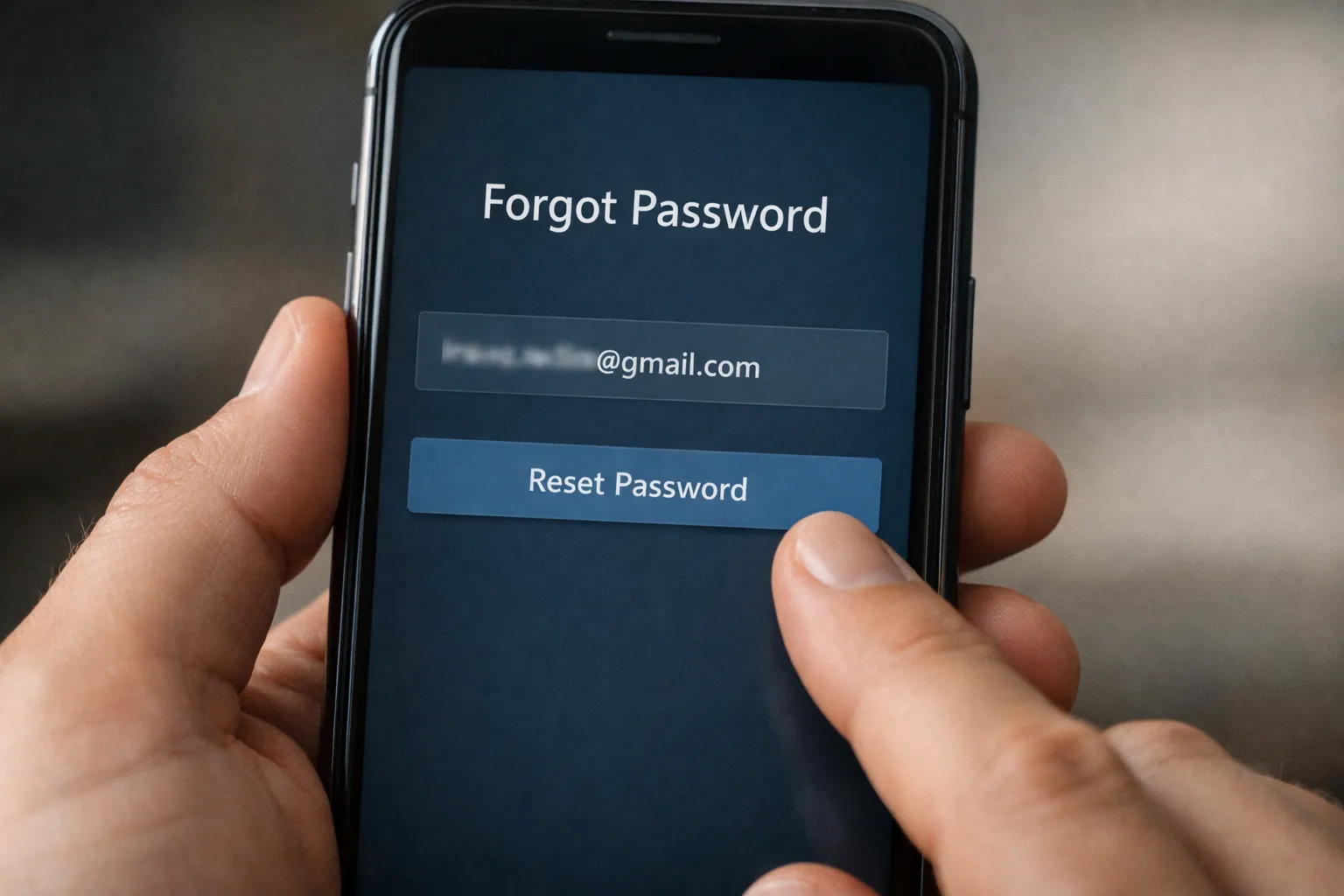

🧨 Mistake 5: Poor Security Practices

So, you’ve mastered the art of not panic-selling—congrats, you’re officially more disciplined than 90% of retail traders.

Join our community of 400K+ and never miss breaking news!

We respect and protect your privacy. By subscribing your info will be subject to our privacy policy . Unsubscribe easily at any time

But, emotional discipline means nothing if you lose your private key to security failures that wipe out your holdings. Ask Stefan Thomas, who’s locked out of 7002 Bitcoins because he forgot his password. That’s $600+ million gathering dust.

To stay safe:

One mistake is all it takes to turn a winning trade into a permanent loss.

💡 Final Thoughts

Every winning trader survived their own mistakes first. Don’t blow yourself up, and the gains eventually take care of themselves.

Want crypto alpha that actually works? 🔥 Join 52k+ traders on Telegram for lightning alerts + weekly newsletter with exclusive market breakdowns.