Bag Holder Syndrome Explained: Stop Holding Losing Crypto Trades

Get Breaking News First!

Editor’s choice

“I just need it to 5x to break even,” David muttered as his tech stock tanked another 30%.

Sound familiar? We’ve all been there, clutching a losing trade like a first crush, hoping for a miracle pump.

Most traders lose money for one simple reason: they can’t let go.

The psychology behind becoming a bag holder is both fascinating and dangerous, and it’s the silent killer of trading accounts.

Join our community of 400K+ and never miss breaking news!

We respect and protect your privacy. By subscribing your info will be subject to our privacy policy . Unsubscribe easily at any time

This guide breaks down why traders hold losers and how to finally cut ties before your portfolio bleeds out.

💡Who Is a “Bag Holder”?

A bag holder is that trader clinging to a sinking asset like a cat stuck to a curtain, whispering “it’ll bounce back…”.

They hold losing trades long after warning signs flash red, letting emotions override logic.

You’ll see them everywhere, stocks, crypto, NFTs, usually left behind after smart money has already exited.

Want to avoid being one? Learn smart money concepts to enter and exit like the pros.

🚨 Why Traders Hold Losing Positions: Key Psychological Biases

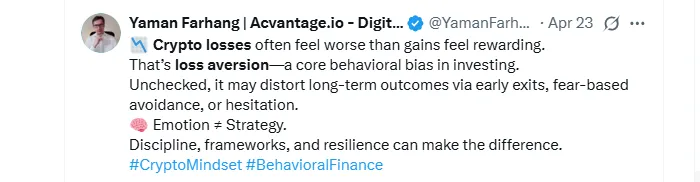

⛔ Loss Aversion

Even seasoned traders freeze when their portfolio bleeds red. The pain of losing $1,000 feels about twice as strong as the joy of gaining it.

This fear often turns traders into bag holders, gripping losing positions like a toddler clinging to a favorite blanket.

The brain whispers, “It’s not a loss until I sell!”—so they hold, hoping for a miracle recovery instead of cutting their losses.

⚠️Sunk Cost Fallacy

The more you invest time, money, or emotion, the harder it is to walk away. You think, “I’ve come this far, I can’t quit now.”

But those losses are already gone. Holding on, hoping to “make it back,” only keeps you stuck in bad trades and blinds you to better opportunities.

Join our community of 400K+ and never miss breaking news!

We respect and protect your privacy. By subscribing your info will be subject to our privacy policy . Unsubscribe easily at any time

👉 Want to spot better setups early? Here’s how to use Google Trends for market analysis to find where real interest is building.

💢Confirmation Bias

When a trade goes south, traders start hunting for any news that tells them they’re still right.

That bearish analyst report? Must be a conspiracy!

The declining revenue? Just a temporary blip!

You’ll even catch yourself scrolling through social media at 2 AM, desperately seeking that one random tweet that agrees with your position.

This confirmation bias isn’t just about ignoring the bad news, it’s about actively seeking validation for your existing beliefs, even when the market’s screaming “You’re wrong!” at full volume.

This selective information gathering often leads to emotional trading decisions that can severely impact your portfolio’s performance.

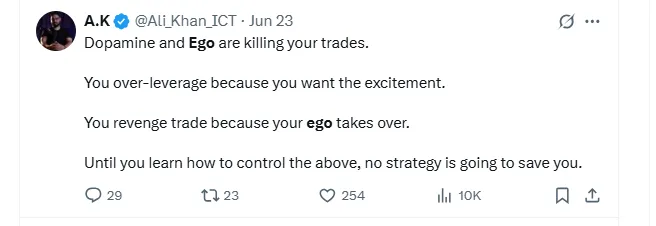

☠️Overconfidence and Ego

Winning trades can make you feel untouchable, right up until the market humbles you.

This overconfidence often spirals into doubling down on bad trades, taking reckless risks, or revenge trading after losses.

Remember that the market doesn’t care about your ego. It’ll happily teach you humility one trade at a time.

😎 Actionable Strategies to Avoid Bag Holding

Protecting yourself from becoming a bag holder requires more than just crossing your fingers and hoping for the best.

So, here’s your battle plan:

- Set clear stop-losses before entering trades. No exceptions, no excuses.

- Size positions like you’re building a house of cards. One wrong move shouldn’t topple everything.

- Research thoroughly, because FOMO is your portfolio’s worst enemy.

- Create clear exit strategies that you’ll actually follow.

- Practice emotional detachment to prevent impulsive decisions.

Extra pro tip? Use this guide to on‑chain data: wallet flows and whale signals to spot smart money moves before they happen.

🔏 Final Thoughts

Successful traders know that holding a losing position and hoping for a miracle is gambling—not strategy.

Master your emotions, plan your exits, and treat trading like a business, not a slot machine. Learn to take small losses so you can survive to trade another day.

Want crypto alerts that matter? 🔥 Join 20k+ sharp traders on Telegram for instant updates and join our newsletter for deep market analysis—straight to your inbox every week.